Bill McGarvey

“When my co-founder and I began discussing Climate Change issues in the Spring of 2019, I was shocked to discover that there is no internationally agreed upon standard for what constitutes truly sustainable business practices.”

“As far as I’m concerned, there are only two aesthetic categories of artists: those who blink and those who don’t.” The comment came from a former college professor of mine during a discussion about the film Trainspotting. In my other life as a cultural commentator, there is a high value placed on the ability to portray reality with unblinking honesty. To my mind, the same principal of taking an unflinching look at what is true should also apply to the conversation around climate and money.

And yet somehow it doesn’t.

There is endless talk of the urgency surrounding the climate crisis; the best of it based on overwhelming scientific data. We are given timelines, deadlines and fine lines for what needs to happen by what year in order to avert environmental catastrophe. But despite this burning existential platform the global response has been diffuse and disjointed.

Individual, local and governmental actions are essential but it is incremental and ultimately doesn’t address the much larger role of business and industry. The investment of vast amounts of capital has a moral obligation to create truly sustainable business models. It doesn’t take an economist or political scientist to understand that the principle of maximizing shareholder profit–the foundational metric in our economic system–is rendered utterly meaningless if it results in the actual destruction of shareholders. Corporate decision making can no longer be treated as if it exists in a moral vacuum.

When my co-founder, Peter McKillop, and I began discussing these issues in the Spring of 2019, I was shocked to discover that there is no internationally agreed upon standard for what constitutes truly sustainable business practices. There is no equivalent of the Universal Declaration of Human Rights for the environment. No Good Housekeeping Seal of Approval for deciding which approaches and actions are truly green and which are simply greenwashing.

In the place of any standards, corporate and business interests have promoted the idea of ESG investing that lumps together environmental (E) issues with social (S) and governance (G) issues. But that is a bit like physicians promoting a health index that monitors the heart, the shoulders and the elbows and telling patients that the health of all three elements are equally essential when only the heart’s health actually has life or death consequences.

I believe there are two reasons for this: the first is the overwhelming complexity and scope of the global issue, the second is the fact that so many of us are on some level implicated because our futures are tied up in the system through our own investments, retirement accounts, pensions etc. Climate and Capital’s mission is to demystify the first issue through incisive reporting and rigorous analysis of the problem. It is only with that clarity and actionable advice that we will be able to exert real pressure upon corporations, governments and individuals to replace the notion of short-term profit with long-term survival.

The issue is enormous and the stakes couldn’t be higher. We promise not to blink.

Read more from Bill

October 5, 2019

Cornerstone Capital’s New Framework for Climate Investing

In No Place to Hide, Cornerstone warns that asset managers cannot simply avoid climate risks by moving out of…

September 21, 2019

Heatwave in India

Eco Watch – Nearly 50 people died on Saturday in one Indian state as record-breaking heatwaves across the…

September 21, 2019

Greta and Larry: At the Crossroad of Climate and Capitalism

Two profoundly important movements are growing and converging. The first is the global uprising against the…

September 21, 2019

2019 UN Climate Summit: Deforestation Disaster–When rhetoric meets reality

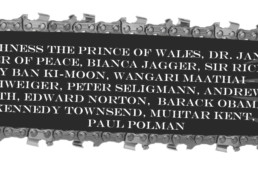

All these leaders - and many, many more - have participated in events organized by the United Nations and…

September 21, 2019

Wildfires in Catalan

A wildfire in Torre de l’Espanyol, a municipality in the Catalan province of Tarragona, continues to burn out…